Where can I buy and compare life insurance?

Choosing the right life insurance can be challenging. There are generally three ways to buy life insurance in Australia and there are advantages and disadvantages to each method. The information below may help you decide what is best suited to you and your objectives, financial situation and needs.

How we compare to advised life insurers

Purchasing life insurance through a financial adviser or broker

You can purchase a life insurance policy through a financial adviser, financial planner or life insurance broker who can guide you through the process of purchasing life insurance, including the different types of cover available, and the level of cover that is right for you.

How the NobleOak model compares: NobleOak is a direct life insurer, which means you can purchase a policy directly, without needing to go through a financial adviser or insurance broker. There are two main things you may want to consider when comparing NobleOak to life insurance taken out through an adviser.

Dealing with a middleman: While financial advice is included in the services provided by an adviser or financial planner, you might want to consider that this advice typically comes with the extra cost of fees and commissions paid by the insurer to the adviser, which may then be factored into the premiums you pay. With NobleOak, you deal directly with our Australian based team where we offer personal service and quality cover without any extra fees. While we offer personal service, we cannot offer you advice that takes into account your objectives, financial situation and needs.

The cost of your premiums: NobleOak reduces overheads so that we can offer competitive premiums. An advised life insurer typically has higher overheads, which may result in higher premiums.

How we compare to other direct life insurers

Purchasing life insurance directly

The NobleOak model means you can purchase a policy directly through a Life insurer without a ‘middleman’. Direct insurers operate in a variety of ways, and the products they offer can be quite different. When you are comparing direct life insurers, there are a few things you may want to consider.

Quality of cover: Direct life insurers will often offer only limited cover or low level amounts of cover. NobleOak offers quality and fully underwritten life insurance up to $25 million, which means you can choose the level of cover to suit your individual needs and circumstances.

Underwritten insurance: Some direct life insurers, including NobleOak, offer fully underwritten cover. This means a number of health, occupation and lifestyle questions are asked upfront and sometimes requires medical tests and access to your medical records. This results in greater certainty for the insurer about the risks that will be taken when insuring you, leading to a greater level of certainty for you at claim time. Meanwhile, some other direct life insurers might only offer partially underwritten cover, which your individual circumstances and risk factors are not factored in. This may increase uncertainty during claim time and potentially increase the cost of your cover.

Claims experience: Direct life insurers sometimes include additional built-in exclusions which can cause uncertainty or surprises at claim time. NobleOak’s fully underwritten cover is designed to minimise this uncertainty by assessing your situation upfront, so you know what you are covered for.

The cost of your premiums: Some direct life insurers may need to account for higher overheads due to having intermediaries or reseller fees, which can result in higher premiums being passed onto a policy. At NobleOak we do not pay any intermediary or reseller fees.

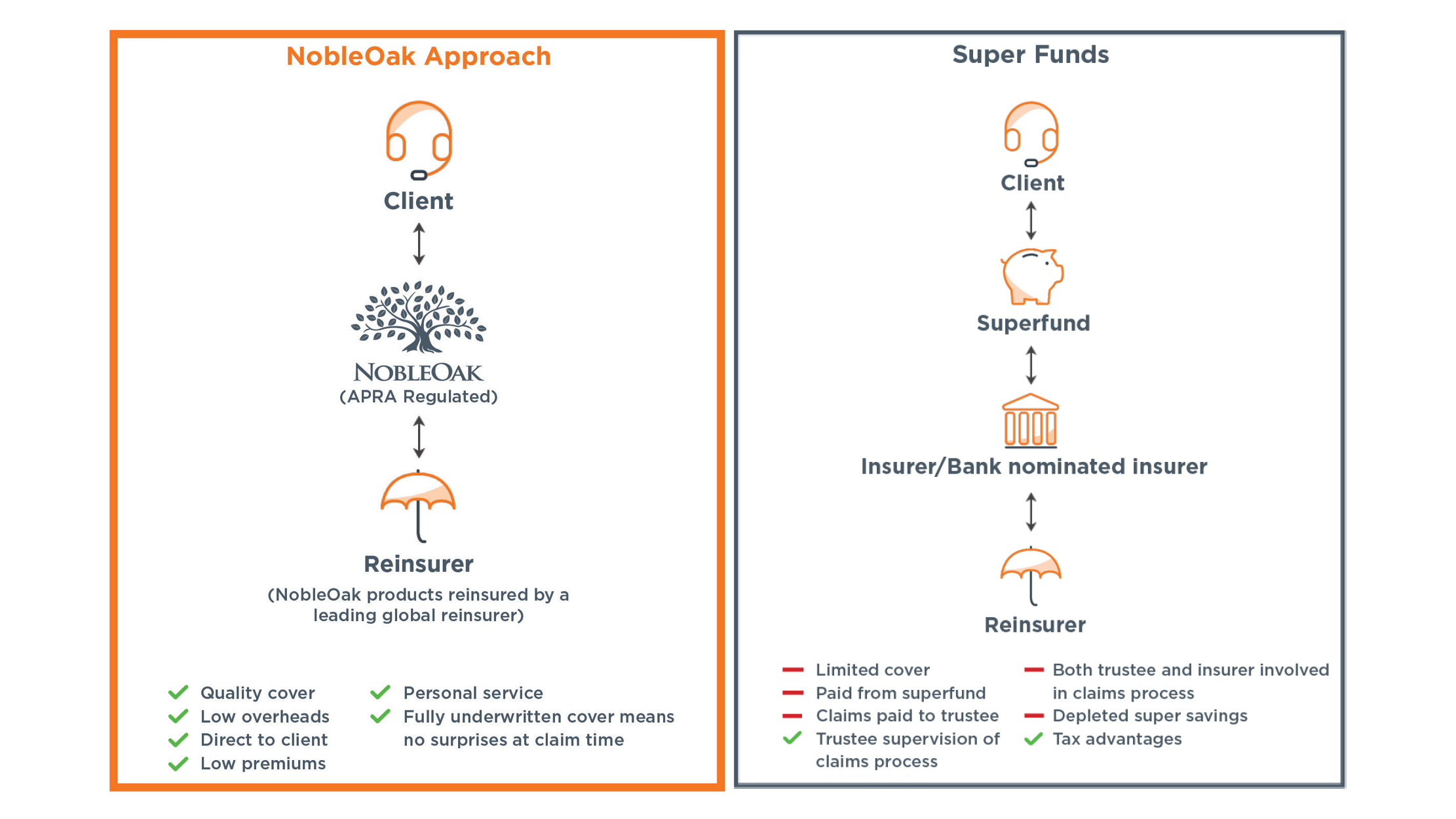

How we compare to insurance through super funds

Obtaining life insurance through your superannuation fund

Many people have some life insurance in their superannuation fund, which has usually been arranged by their employer or their superannuation fund. There are a few key differences between purchasing a life insurance policy from a direct life insurer such as NobleOak and holding life insurance products through your superannuation fund.

Cover amounts: A superannuation fund can only offer a limited amount of cover that might not be enough for your needs and personal circumstances.

Impact on your super balance: Taking out a policy with your superannuation fund means fees are paid from your superannuation balance, which results in reduced super savings. In some cases, when your super balance drops below a certain amount, your insurance must be cancelled, and you may only come to realise this at claim time, leaving you uninsured. When you purchase life insurance through NobleOak, it is a separate policy that does not impact your superannuation balance.

Life insurance product availability: Generally only life cover, TPD Insurance and sometimes Income Protection Insurance can be purchased through a super fund. Trauma insurance is not available within superannuation but is one of the cover types available through NobleOak outside superannuation.

Claims experience: NobleOak has a dedicated claims team that will help you and your loved ones throughout the entire process.

Tax advantages: There may be some tax advantages for you to hold your life insurance policy through superannuation fund. Life insurance and TPD insurance purchased within your super is generally not personally tax deductible. However, if it is purchased through a Self-Managed Super Fund (SMSF), the SMSF may be able to claim premiums in its annual tax return under certain circumstances. This is NobleOak’s understanding of the current general tax treatment of Life Insurance and TPD insurance. You can find more information about taking out NobleOak Life Cover within an SMSF here and should consult with a tax professional or financial planner if purchasing through an SMSF. Income Protection policy premiums for cover provided through a superannuation fund are not deductible against your personal income if the premiums are deducted from your superannuation contributions.